Digital banking platform market has witnessed a significant evolution in recent years, driven by technological advancements, changing consumer preferences, and the need for more agile and customer-centric financial services. Digital banking platforms offer a comprehensive suite of services, ranging from online account management and mobile banking to advanced analytics and personalized financial advice. This article explores the key trends, major players, and future prospects in the dynamic landscape of the digital banking platform market.

Market Size and Growth:

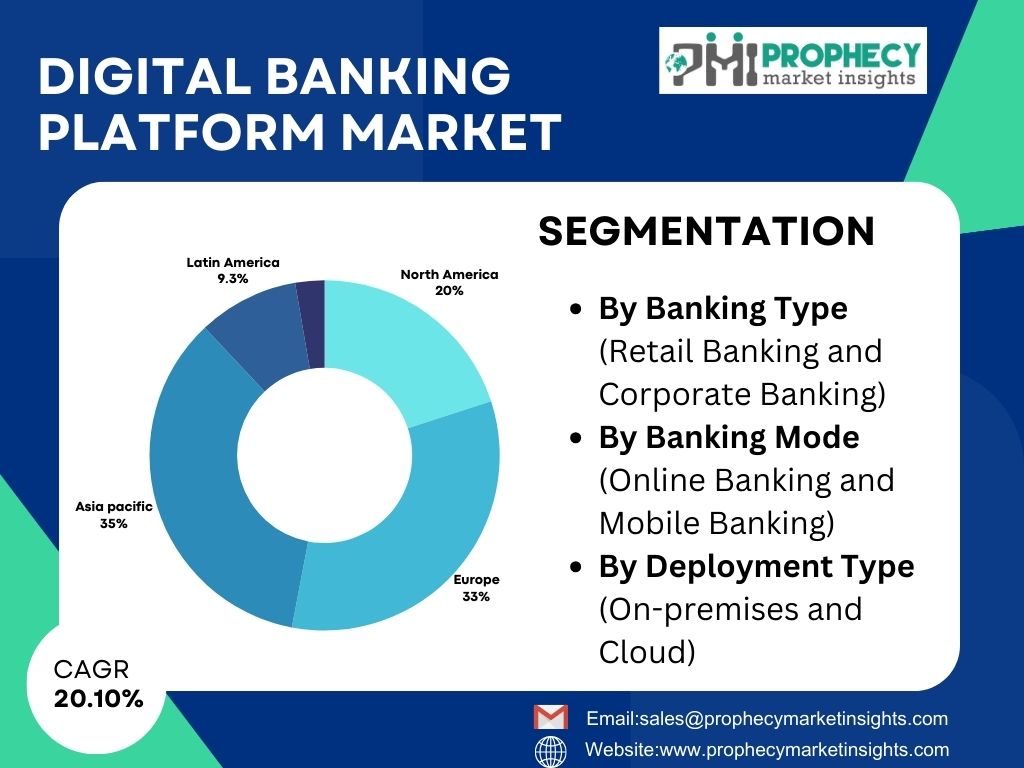

Digital banking platform market is estimated to reach US$ 20.8 Billion in 2024 and is estimated to be US$ 130.1 Billion by 2034 and is anticipated to register a CAGR of 20.10%.

𝗧𝗼 𝗮𝗰𝗰𝗲𝘀𝘀 𝘁𝗵𝗲 𝗳𝘂𝗹𝗹 𝗺𝗮𝗿𝗸𝗲𝘁 𝗿𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗿𝗲𝗽𝗼𝗿𝘁, 𝗰𝗹𝗶𝗰𝗸 𝗵𝗲𝗿𝗲:

https://www.prophecymarketinsights.com/market_insight/Global-Digital-Banking-Platform-Market-706

Key Trends Shaping the Digital Banking Platform Market:

- Rise of Neobanks: Neobanks, or digital-only banks, have gained prominence as disruptive players in the financial services industry. These banks operate exclusively online, leveraging digital banking platforms to provide customers with seamless, user-friendly, and often more cost-effective banking experiences. The rise of neobanks has intensified competition and spurred traditional banks to enhance their digital offerings.

- Mobile-First Approach: The widespread adoption of smartphones has led to a mobile-first approach in the digital banking platform market. Customers increasingly prefer managing their finances through mobile applications, prompting banks to invest in responsive, feature-rich mobile banking platforms. Mobile banking apps provide users with convenient access to a range of services, from account balance inquiries to fund transfers.

- Open Banking Initiatives: Open banking, facilitated by regulatory changes and technological innovations, allows third-party developers to access financial data from banks with user consent. Digital banking platforms are playing a crucial role in enabling open banking initiatives, fostering collaboration between traditional banks and FinTech companies to create a more interconnected and competitive financial ecosystem.

- Enhanced Security Measures: With the growing prevalence of cyber threats, digital banking platforms are prioritizing robust security measures. Biometric authentication, multi-factor authentication, and advanced encryption technologies are being integrated to safeguard customer data and transactions. Building and maintaining trust in the security of digital banking services is a key focus for providers.

Request Your Free Sample Now!

https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/706

Major Players in the Digital Banking Platform Market:

- Appway AG

- Backbase, Inc.

- CREALOGIX AG

- Infosys Limited

- Intellect Design Arena

- Finastra Technology Inc

- ETRONIKA

- UAB

- Groupe BPCE

- Fiserv, Inc

- Kony, Inc.

Market segmentation:

- By Banking Type (Retail Banking and Corporate Banking)

- By Banking Mode (Online Banking and Mobile Banking)

- By Deployment Type (On-premises and Cloud)

- By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa)

Download a PDF Brochure:

https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/706

Future Prospects of the Digital Banking Platform Market:

- Artificial Intelligence (AI) and Personalization: The integration of AI in digital banking platforms is expected to play a transformative role. AI-driven analytics can provide personalized insights, automate routine tasks, and enhance customer engagement. The future will likely see an increased focus on AI applications, such as chatbots and virtual assistants, to provide real-time support and personalized financial advice.

- Blockchain Technology: Blockchain technology holds the potential to revolutionize various aspects of digital banking, including security, transparency, and transaction efficiency. Digital banking platforms may incorporate blockchain solutions for secure and transparent cross-border transactions, smart contracts, and identity verification, contributing to a more robust and efficient financial ecosystem.

- Ecosystem Integration and Partnerships: Digital banking platforms are likely to become more integrated with broader financial ecosystems. Partnerships between banks, FinTech firms, and other service providers will become increasingly common. This collaborative approach will enable banks to offer a broader range of services, from insurance and investment products to third-party applications within their digital platforms.

- Emphasis on Financial Wellness: Future digital banking platforms may place a greater emphasis on promoting financial wellness. This could involve integrating tools for budgeting, savings, and investment advice directly into the platform. Offering customers holistic financial insights and guidance aligns with the evolving expectations for digital banking services.

Conclusion:

The digital banking platform market is undergoing a paradigm shift, driven by technological innovations and changing consumer behaviors. As digital banking becomes more ubiquitous, financial institutions and technology providers are racing to offer seamless, secure, and personalized experiences to their customers. The future of the digital banking platform market holds exciting prospects, with advancements in AI, blockchain, and ecosystem integration poised to redefine the landscape. As financial institutions continue to adapt and innovate, the digital banking platforms of tomorrow will play a pivotal role in shaping the future of financial services.

To know more

Contact Us:

Sales

Prophecy Market Insights

📞+1 860 531 2574

✉ Email– sales@prophecymarketinsights.com

🌐 Website- www.prophecymarketinsights.com

🌐 Blog- www.prophecyjournals.com

Follow us on: