Remittance market, representing the flow of financial transfers from migrant workers to their home countries, is a critical component of the global economy. As technology, economic factors, and regulatory landscapes evolve, the remittance market undergoes significant changes. Explores the current trends, challenges, and future prospects in the remittance market.

𝗧𝗼 𝗮𝗰𝗰𝗲𝘀𝘀 𝘁𝗵𝗲 𝗳𝘂𝗹𝗹 𝗺𝗮𝗿𝗸𝗲𝘁 𝗿𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗿𝗲𝗽𝗼𝗿𝘁, 𝗰𝗹𝗶𝗰𝗸 𝗵𝗲𝗿𝗲:

https://www.prophecymarketinsights.com/market_insight/Global-Remittance-Market-4707

Market Size and Growth:

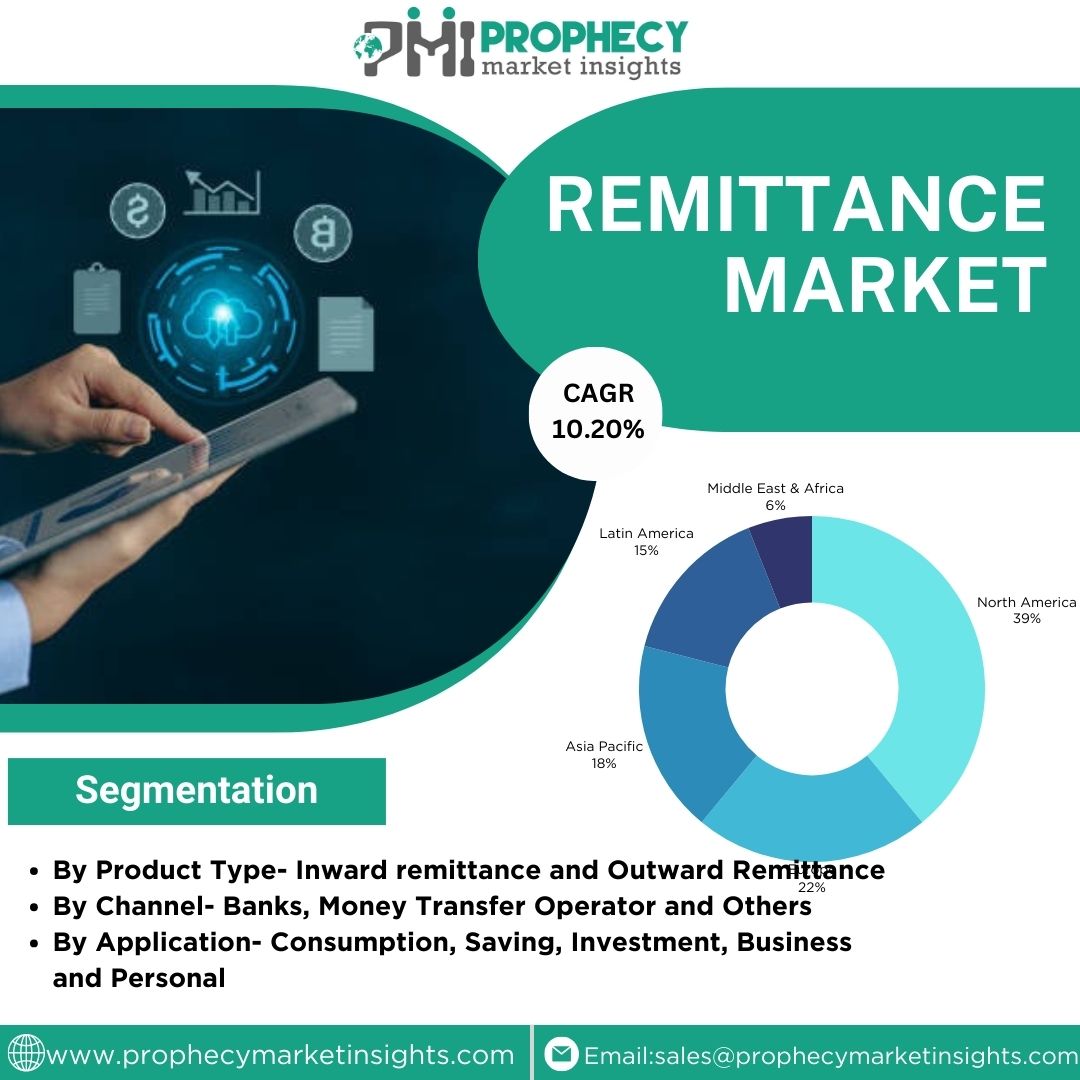

Remittance Market is estimated to reach US$ 64.3 billion in 2024 and is estimated to be US$ 170 billion by 2034 and is anticipated to register a CAGR of 10.20%.

Request Your Free Sample Now!

https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/4707

Market Overview and Growth Factors:

Remittance market plays a pivotal role in the global financial system, connecting migrant workers with their families and supporting the economic development of receiving countries. According to the World Bank, remittances to low- and middle-income countries reached over $700 billion in 2021. The market’s growth is driven by factors such as increased migration, improved technology, and the need for efficient cross-border fund transfers.

Digital Transformation in Remittance Services:

The remittance industry has witnessed a notable shift towards digital channels. Traditional methods, such as cash pickups and money transfers through physical agents, are being supplemented and, in some cases, replaced by online platforms and mobile apps. Digital remittance services offer convenience, speed, and cost-effectiveness, attracting a growing number of users who seek efficient and accessible ways to send money across borders.

Blockchain and Cryptocurrency in Remittances:

Blockchain technology and cryptocurrencies are gaining traction in the remittance market. These technologies address challenges such as high transaction costs and slow processing times. Cryptocurrencies, like Bitcoin and stablecoins, provide an alternative for cross-border transfers, offering faster transactions and reduced fees. Blockchain, with its transparent and secure ledger system, contributes to enhancing the efficiency and security of remittance transactions.

Download a PDF Brochure:

https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/4707

Key Market Insights from the report:

- By Product type, the Global Remittance Market is segmented into Inward remittance and Outward Remittance.

- By Channel, the market is segmented in Banks, Money Transfer Operator and Others.

- By Application, the Global Remittance Market is segmented into Consumption, Saving, Investment, Business and Personal.

- By Region, the Global Remittance Market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The key players operating in the Global Remittance Market include,

- Citigroup Inc.

- JPMorgan Chase & Co.

- MoneyGram International, Inc.

- Euronet Worldwide

- Western Union Holdings Inc.

- XOOM/ Paypal

- Wells Fargo

- Scotia Bank

Financial Inclusion and Emerging Markets:

Remittances play a crucial role in promoting financial inclusion, especially in regions with limited access to traditional banking services. Mobile money solutions and partnerships between remittance providers and local financial institutions enable recipients to access funds conveniently, fostering financial inclusion in underserved areas.

Regulatory Landscape and Compliance Challenges:

The remittance market faces regulatory challenges due to varying compliance requirements across jurisdictions. Stringent regulations aimed at preventing money laundering and ensuring the security of financial transactions can pose hurdles for remittance service providers. Adapting to and navigating diverse regulatory frameworks are crucial for the sustainable growth of the industry.

Partnerships and Collaborations:

Remittance service providers are increasingly engaging in partnerships and collaborations to expand their reach and improve services. Collaborations between fintech companies, traditional financial institutions, and mobile network operators create synergies that enhance the efficiency of remittance networks. Strategic partnerships also facilitate the integration of new technologies and innovative solutions into existing remittance platforms.

Future Prospects and Innovations:

The future of the remittance market is marked by ongoing innovations. Advancements in artificial intelligence, data analytics, and biometric authentication are expected to enhance security and streamline the user experience. Additionally, increased use of decentralized finance (DeFi) and further integration of blockchain technologies may reshape the landscape, providing more efficient and transparent cross-border payment solutions.

Sustainability and Social Impact:

Sustainability and social impact are gaining prominence in the remittance market. Some remittance service providers are exploring ways to contribute to environmental and social initiatives, aligning with the growing awareness of corporate social responsibility. Initiatives such as promoting financial literacy and supporting community development projects aim to create a positive impact beyond the transactional aspect of remittances.

Conclusion:

Remittance market is undergoing a transformative phase, driven by technological innovations, changing consumer preferences, and a shifting regulatory landscape. As the industry continues to evolve, adapting to digital trends and addressing regulatory challenges will be crucial for sustained growth. The ongoing digital transformation, coupled with innovations in blockchain and cryptocurrency, positions the remittance market at the forefront of financial services, catering to the diverse needs of a globalized world.

To know more

Contact Us:

Sales

Prophecy Market Insights

📞+1 860 531 2574

✉ Email– sales@prophecymarketinsights.com

🌐 Website- www.prophecymarketinsights.com

🌐 Blog- www.prophecyjournals.com

Follow us on: