Mobile payments market has witnessed a remarkable transformation in recent years, driven by rapid technological advancements and changing consumer preferences. As smartphones become ubiquitous and digitalization continues to reshape the financial sector, the mobile payments market is experiencing unprecedented growth. This article explores key trends, challenges, and future prospects within this dynamic market.

Market Size and Growth:

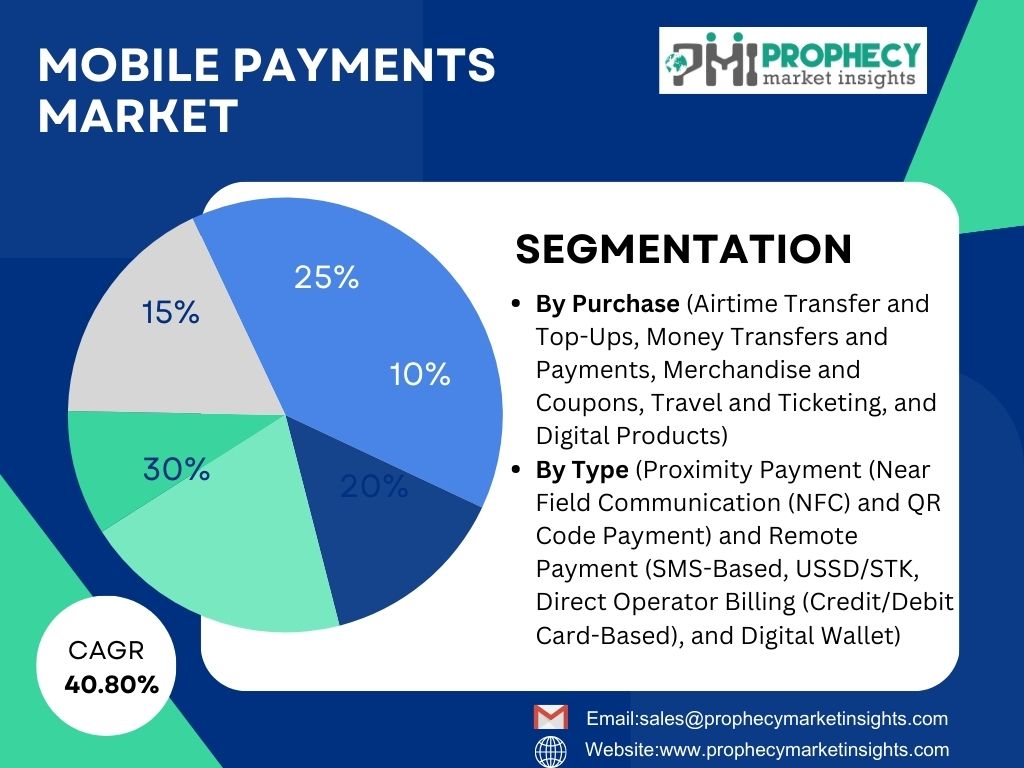

Mobile payments market is estimated to reach US$ 456 billion in 2024 and is estimated to be US$ 14010 billion by 2034 and is anticipated to register a CAGR of 40.80%.

𝗧𝗼 𝗮𝗰𝗰𝗲𝘀𝘀 𝘁𝗵𝗲 𝗳𝘂𝗹𝗹 𝗺𝗮𝗿𝗸𝗲𝘁 𝗿𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗿𝗲𝗽𝗼𝗿𝘁, 𝗰𝗹𝗶𝗰𝗸 𝗵𝗲𝗿𝗲:

https://www.prophecymarketinsights.com/market_insight/Global-Mobile-Payments-Market-By-456

The prominent players operating in the Mobile Payments Market includes,

MasterCard International Inc., Visa, Inc., American Express, Co., Boku, Inc., Fortumo OU, PayPal, Inc., Bharti Airtel Ltd., Vodafone Ltd., AT & T, Inc., Google, Inc., Apple, Inc., Tencent, Ant Financial Services Group, and Microsoft Corporation and others.

Trends Shaping the Mobile Payments Landscape:

- Contactless Payments: The COVID-19 pandemic accelerated the adoption of contactless payments, as consumers sought safer and more convenient ways to transact. Near Field Communication (NFC) technology allows users to make secure and swift transactions by simply tapping their smartphones or wearable devices, reducing the reliance on physical cash.

- Digital Wallets: Digital wallets, also known as e-wallets, have gained immense popularity. These applications store users’ payment information securely and offer a seamless payment experience. Leading digital wallets like Apple Pay, Google Pay, and Samsung Pay have become integral parts of the mobile payments ecosystem, providing users with a diverse range of features beyond basic transactions, such as loyalty programs and ticketing services.

- QR Code Payments: Quick Response (QR) codes have become a ubiquitous feature in mobile payments. Merchants and consumers can complete transactions by scanning QR codes, eliminating the need for physical cards. This technology is particularly prevalent in emerging markets, where it offers a cost-effective and accessible solution for small businesses.

- Peer-to-Peer (P2P) Payments: P2P payments have become increasingly popular for personal and business transactions. Mobile apps like Venmo, PayPal, and Cash App enable users to send and receive money effortlessly, contributing to the decline of traditional cash exchanges.

Request Your Free Sample Now!

https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/456

Key Market Insights from the report:

- Based on Purchase, Mobile Payments Market is segmented into Airtime Transfer and Top-Ups, Money Transfers and Payments, Merchandise and Coupons, Travel and Ticketing, and Digital Products.

- Based on Type, Mobile Payments Market is segmented into Proximity Payment (Near Field Communication (NFC) and QR Code Payment) and Remote Payment (SMS-Based, USSD/STK, Direct Operator Billing (Credit/Debit Card-Based), and Digital Wallet).

- By Region, the Mobile Payments Market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Download a PDF Brochure:

https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/456

Challenges Facing the Mobile Payments Market:

- Security Concerns: Despite technological advancements, security remains a significant concern for both consumers and businesses. Cyber threats, data breaches, and identity theft pose risks to sensitive financial information. Stakeholders in the mobile payments ecosystem must continually invest in robust security measures to build and maintain trust among users.

- Regulatory Hurdles: The mobile payments market operates within a complex regulatory environment. Divergent regulations across different regions and countries can hinder seamless global transactions. Regulatory compliance and standardization efforts are crucial for fostering cross-border mobile payment adoption.

- Interoperability Issues: Achieving interoperability between various mobile payment platforms and systems remains a challenge. Users often face limitations when trying to transact across different apps or service providers, hindering the industry’s overall growth. Collaborative efforts are needed to establish common standards and interoperable solutions.

- Consumer Education: While mobile payments offer numerous advantages, some consumers may still be hesitant to adopt new technologies due to a lack of understanding. Educational initiatives are essential to inform users about the benefits, security features, and ease of use associated with mobile payments.

Future Prospects and Opportunities:

- Integration of Blockchain Technology: Blockchain technology holds the potential to enhance security and transparency in mobile payments. Decentralized ledgers could streamline cross-border transactions, reduce fraud, and enhance overall trust in the mobile payments ecosystem.

- Continued Growth in Emerging Markets: As smartphone penetration increases in emerging markets, the adoption of mobile payments is expected to surge. Governments and businesses in these regions are likely to leverage mobile payments to drive financial inclusion and stimulate economic growth.

- Enhanced User Experience: The future of mobile payments will likely see continuous improvements in user experience, driven by innovations such as biometric authentication, augmented reality, and voice recognition. These enhancements aim to make transactions even more seamless and user-friendly.

- Collaboration and Partnerships: Industry stakeholders will increasingly collaborate to overcome challenges such as interoperability and regulatory hurdles. Strategic partnerships between mobile payment providers, financial institutions, and technology companies will foster innovation and drive the evolution of the mobile payments market.

Conclusion:

The mobile payments market continues to evolve, propelled by technological advancements, changing consumer behavior, and global economic trends. While challenges persist, the industry’s future holds promise with ongoing innovations, regulatory developments, and collaborative efforts. As mobile payments become an integral part of the financial landscape, stakeholders must navigate these dynamics to ensure a secure, seamless, and inclusive digital payment ecosystem.

To know more

Contact Us:

Sales

Prophecy Market Insights

📞+1 860 531 2574

✉ Email– sales@prophecymarketinsights.com

🌐 Website- www.prophecymarketinsights.com

🌐 Blog- www.prophecyjournals.com

Follow us on: