Prepaid cards market has experienced substantial growth and transformation in recent years, driven by changing consumer preferences, technological advancements, and the evolving financial landscape. Prepaid cards, also known as stored-value cards, offer a versatile and convenient alternative to traditional payment methods. This article explores the key trends, opportunities, and future prospects shaping the prepaid cards market.

Market Size and Growth:

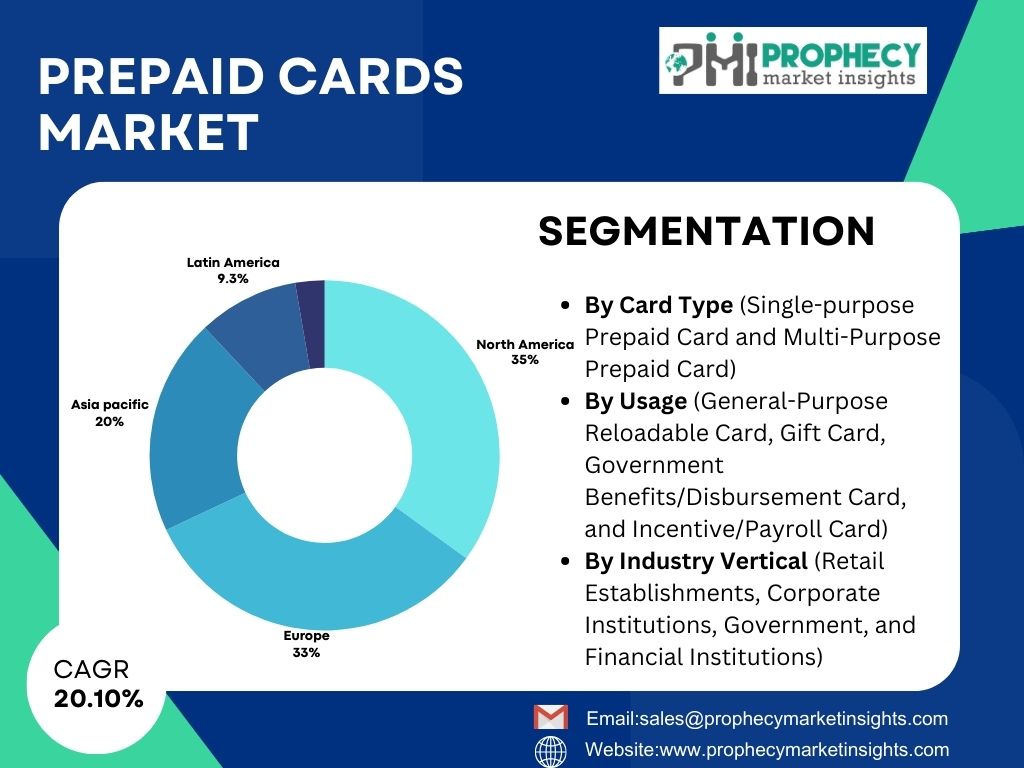

Prepaid Cards Market is estimated to reach US$ 3.5 Trillion in 2024 and is estimated to be US$ 21.9 Trillion by 2034 and is anticipated to register a CAGR of 20.10%.

𝗧𝗼 𝗮𝗰𝗰𝗲𝘀𝘀 𝘁𝗵𝗲 𝗳𝘂𝗹𝗹 𝗺𝗮𝗿𝗸𝗲𝘁 𝗿𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗿𝗲𝗽𝗼𝗿𝘁, 𝗰𝗹𝗶𝗰𝗸 𝗵𝗲𝗿𝗲:

https://www.prophecymarketinsights.com/market_insight/Global-Prepaid-Cards-Market-672

Key Trends Driving the Prepaid Cards Market:

- Rise of Digital Wallets and Contactless Payments: The increasing adoption of digital wallets and contactless payment methods has significantly influenced the prepaid cards market. Many prepaid cards are now available in digital form, allowing users to add them to their mobile wallets. This trend aligns with the growing preference for seamless, secure, and contactless transactions.

- Financial Inclusion Initiatives: Prepaid cards play a crucial role in promoting financial inclusion by providing a viable banking solution for individuals without traditional bank accounts. Governments and financial institutions globally are leveraging prepaid cards to disburse social benefits, wages, and subsidies, reaching unbanked and underbanked populations.

- Gift and Incentive Programs: The use of prepaid cards in gift and incentive programs has gained momentum. Businesses utilize these cards for employee recognition, customer loyalty programs, and promotional campaigns. The flexibility and customization options associated with prepaid cards make them an attractive choice for corporate incentives.

- Travel and Expense Management: Prepaid travel cards have become popular among travelers seeking a secure and convenient way to manage expenses abroad. These cards offer favorable currency exchange rates and eliminate the need for carrying large amounts of cash. Additionally, businesses are increasingly using prepaid cards to manage employee expenses.

Request Your Free Sample Now!

https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/672

Major Players in the Prepaid Cards Market:

- Green Dot Corporation

- NetSpend Holdings, Inc.

- H&R Block Inc.

- American Express Company

- JPMorgan Chase & Co.

- PayPal Holdings, Inc.

- BBVA Compass Bancshares, Inc.

- Mango Financial, Inc.

- UniRush, LLC

- Kaiku Finance LLC.

Market segmentation:

- By Card Type (Single-purpose Prepaid Card and Multi-Purpose Prepaid Card)

- By Usage (General-Purpose Reloadable Card, Gift Card, Government Benefits/Disbursement Card, and Incentive/Payroll Card)

- By Industry Vertical (Retail Establishments, Corporate Institutions, Government, and Financial Institutions)

- By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa)

Download a PDF Brochure:

https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/672

Future Prospects of the Prepaid Cards Market:

- Technological Advancements: The future of the prepaid cards market is likely to be shaped by continuous technological advancements. Integration with emerging technologies such as blockchain and the Internet of Things (IoT) may enhance security, streamline transactions, and open up new possibilities for prepaid card functionalities.

- Expansion of Use Cases: Prepaid cards are expected to find new applications beyond traditional areas. This includes the integration of prepaid cards with subscription services, healthcare payments, and other niche segments. The versatility of prepaid cards makes them adaptable to a wide range of consumer needs.

- Enhanced Security Features: Given the increasing concern for cybersecurity, future prepaid cards are likely to incorporate advanced security features such as biometric authentication, multi-factor authentication, and real-time fraud detection. These measures aim to provide users with a secure and trustworthy payment experience.

- Global Market Growth: The prepaid cards market is anticipated to witness substantial global growth as more regions embrace cashless economies and governments leverage prepaid solutions for financial inclusion initiatives. Emerging markets, in particular, present significant opportunities for prepaid card providers to expand their reach.

Conclusion:

The prepaid cards market is undergoing a dynamic transformation driven by technological innovation, changing consumer preferences, and a focus on financial inclusion. The adaptability and versatility of prepaid cards position them as a vital component of the evolving payments landscape. As major players continue to innovate and as new entrants explore niche opportunities, the future of the prepaid cards market looks promising. Businesses, financial institutions, and consumers alike stand to benefit from the continued expansion and enhancement of prepaid card offerings in the global financial ecosystem.

To know more

Contact Us:

Sales

Prophecy Market Insights

📞+1 860 531 2574

✉ Email– sales@prophecymarketinsights.com

🌐 Website- www.prophecymarketinsights.com

🌐 Blog- www.prophecyjournals.com

Follow us on: